Report - Celebrations of Insurance Awareness Day-2016 - Policy Holder

Report - Celebrations of Insurance Awareness Day-2016

Continuing the tradition of celebration of IRDAI’s ‘Formation Day’ as Insurance Awareness Day, IRDAI celebrated it on 19th April, 2016 at Hyderabad. Shri Yaga Venugopal Reddy, Chairman,14th Finance Commission and Former Governor, Reserve Bank of India, graced the occasion as ‘Chief Guest’.

The celebrations, on the very day, were started with Finals of Pan India Quiz Competition. Teams from four insurance companies participated in the finals after qualifying semi-finals. Prior to the finals of the Competition, there were eight groups for quarter finals consisting of 6/7 teams of Insurance Companies and each team had 3 members of the Insurance Company. Out of 54 insurance companies, 44 teams participated in the Competition. While the team from National Insurance Co. Ltd. was the Winner, the team from Exide Life Insurance Co. Ltd. was the Runner-up of the quiz competition.

The quiz competition was followed by a ‘Panel Discussion’ on ‘Best Insurance Awareness Policies of the insurers’ moderated by Shri PJ Joseph, Member (Non-Life). The panel was unanimous about having a multipronged and multi-agency approach towards insurance awareness with print, electronic and social media involving all stakeholders viz. insurance companies, educational institutions, insurance councils, other regulators, government along with IRDAI. The members of the panel said in one voice that simple social insurance schemes launched by the government and their publicity by all stakeholders for popularizing these schemes, will certainly improve insurance inclusion. The members were of the view that three ‘Cs’ Customer Education, Claim Handling and Complaint Resolution can create confidence and trust in the insurance industry, which may lead to greater insurance inclusion both in life and general insurance including health insurance segments.

The main function started with the lighting of the lamp by the Chief Guest, Dr YV Reddy followed by launching of the IRDAI’s Consumer Education Material in Telugu and Hindi.

Prizes were distributed to the winners of the Pan India Quiz Competition-2016 and South Zone winners of the third National Financial Literacy Assessment Test – 2015-16 (NFLAT 2015-16) conducted by National Centre for Financial Education (NCFE) to measure the level of financial literacy among school student.

The NCFE-NFLAT 2015-16 was conducted on 28 & 29th November, 2015 in which more than 1,25,000 student from over 2000 schools registered from all over the Country in more than 340 locations.

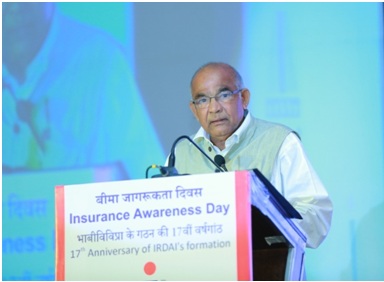

Shri TS Vijayan, Chairman, IRDAI in his welcome address, briefed about the latest important developments of the insurance sector following the delegation of greater regulatory powers to IRDAI through various regulations including Insurance Laws (Amendment) Act, 2015. With the amendment in the Insurance law, it has paved the way for opening of branches by reinsurers from outside India and the entry of these reinsurers will help Indian Insurance Companies to access the global capital. He said both life and general insurance sector achieved a double digit growth in the last financial year while the health insurance registered 35-40% growth in premium collection. He hoped that the insurance industry would do well in the current financial year since the monsoon was expected to be good.

Chief Guest, Dr YV Reddy, while addressing the participants, congratulated all the prize winners of various Competitions for their excellence and talked about the importance of insurance awareness. He further spelled out the peculiarities of financial services in comparison to any other goods or services as financial services are exchange of claims over time, space, uses and risks, information asymmetry between the financial intermediary and the customer, limited liability and highly leveraged nature of entities. The role of financial regulator would be to repose trust of the members of public on the financial sector and the financial intermediaries. He stated that the emphasis of financial regulators on financial inclusion started with the global financial crisis. However, he cautioned that financial inclusion is a means and not an end for economic development and other aspects of progress. While appreciating the efforts of the IRDAI in promoting insurance literacy through a call centre, consumer education website etc., he urged upon IRDAI to consider realigning the call centre as a query centre to provide generic information for financial literacy at the point of need on a 24X7 basis in regional languages. He appreciated the efforts taken by IRDAI in building a competitive and sound insurance sector, thereby fulfilling the dual roles of policyholder protection and ensuring orderly growth of the insurance sector, making it unique and respected insurance regulators in the world.

Thereafter, the Cultural Programme was begun with the Comedy Show followed by spectacular performances of music and dance by the staff of IRDAI as well as their Children. The audience was enthralled by the performances and everyone appreciated the IRDAI for organizing such a gala event.